Markets are buying President Lee’s promises

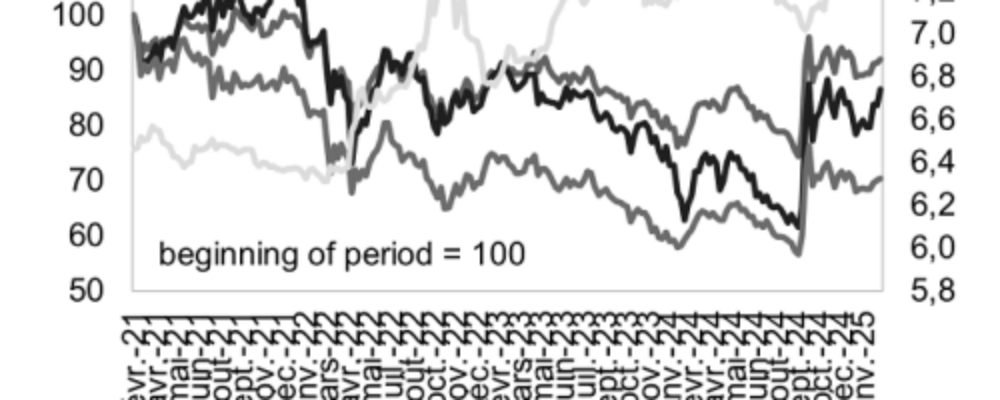

Renewed political stability is undoubtedly one of the factors behind the surge in South Korean stock prices. During the presidential election campaign, Lee pledged to lift South Korea’s main stock market index, the Kospi, which in April stood at just over 2,500 points, to 5,000 points. With the index closing at around 4,000 points in recent weeks, this goal now appears to be within reach.

South Korea is set to post the world’s best stock market performance of 2025. Share prices have been buoyed by the semiconductor sector, and particularly Samsung Electronics and SK Hynix, which alone account for 31% of South Korea’s total market capitalisation. These two firms occupy extremely strong positions in new technology value chains, supplying memory components used in Nvidia chips.

The market had mainly been driven by domestic flows, but large amounts of foreign capital are now beginning to flow in: net purchases of South Korean securities by non-residents have totalled $11 billion since the beginning of May. Foreign investors are now betting on a transition like the one that took place in Japan, where a raft of corporate governance reforms fuelled a stock market surge in the 1980s.

The ownership structure of South Korean groups is still largely dominated by a small number of key families. South Korea’s tax system encourages these families to moderate how far and how fast the prices of the shares they hold rise, which partly explains why assets are so undervalued, especially when compared with US tech firms.

Accordingly, among the Lee government’s first reforms is an overhaul of the rights of minority shareholders to make the governance of large conglomerates (chaebols) more transparent. The planned measures are aimed at curbing the power of controlling shareholders and broadening boards’ fiduciary responsibility and composition (giving minority shareholders greater representation).

Recent market performance rewards not only President Lee’s early reforms but also South Korea’s industrial positioning, with the country still at the forefront of technology in the semiconductor sector.

After a slowdown at the start of the year linked to uncertainty around US trade policy and expectations among importers, who had ramped up purchases in anticipation of Donald Trump’s announcements, the cycle once again reversed. Semiconductor exports have seen double-digit growth since March 2025, buoyed in particular by US investment in software, which greatly benefits South Korean firms involved in this value chain. They have also fuelled a record trade surplus of more than $80 billion over a rolling 12-month period.

Excluding exports, however, stock market performance has yet to really filter through into other activity indicators, particularly on the demand side. Improvements in purchasing power and employment have so far been modest, since businesses related to the sector are primarily capital-intensive. Another transmission channel might have been wealth effects, but these remain relatively muted in South Korea, where consumer holdings of financial assets are limited, with the majority (75%) of household wealth invested in real estate.

South Korea thus runs the risk of becoming locked into a two-speed model focused on the contribution made by the most competitive chaebols (notably Samsung and SK Hynix) despite their success being of only modest benefit to the rest of the economy, particularly as regards the labour market (chaebols account for around 20% of total employment, taking into account indirect employment) and purchasing power gains.

“Crédit Agricole Group, sometimes called La banque verte due to its historical ties to farming, is a French international banking group and the world’s largest cooperative financial institution. It is France’s second-largest bank, after BNP Paribas, as well as the third largest in Europe and tenth largest in the world.”

Please visit the firm link to site