Market uncertainty has become a structural feature of the operating environment. Interest rates, input costs, labour dynamics, and geopolitical alignments are shifting simultaneously, often in divergent and unpredictable ways. These developments are compressing decision-making windows and increasing the financial consequences of delayed responses.

In this context, effective leadership depends not on prediction, but on early and accurate interpretation of change. The ability to distinguish signal from noise — and to translate external dynamics into internal action — is now a core capability for executive teams.

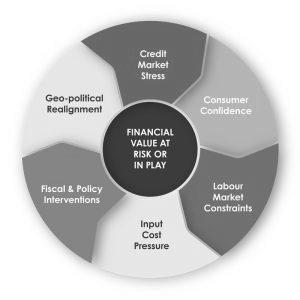

At Q5, we focus on six interconnected signals that offer early visibility into how external forces are likely to evolve — and where they may create exposure, constraint, or opportunity. Taken together, they provide a practical lens for interpreting uncertainty, enabling leadership teams to stay ahead of disruption through timely, informed decision-making.

Signals you need to be watching out for

1. Credit Market Stress

“The earliest signal of tightening capital conditions — and competitive pressure.”

Credit markets often move ahead of the real economy, offering an early read on capital availability and pricing. Rising spreads, tighter lending standards, or default risk signal a shift in financial risk appetite — with direct implications for funding, refinancing, and investment.

But it’s not only about systemic stress. High leverage across the market creates vulnerability. Businesses reliant on cheap capital may face refinancing at a premium — or not at all — creating structural pressure, but also opportunity for stronger players: acquisition targets, distressed assets or fewer competitors.

What this means strategically:

Hold off on high-cost borrowing unless the return is compelling. Track leverage across your market to identify risk — or openings — as weaker players restructure or retrench.

What this means financially:

Review debt maturity profiles, covenant exposure, and liquidity headroom. Scenario-test refinancing costs. Understand how rising risk premiums affect M&A or investment timing.

Indicators to watch (leading): High-yield vs. government bond spreads; BoE Credit Conditions Survey; Corporate debt-to-GDP ratios; Refinancing maturity walls (sector-specific); Default Rates (e.g., S&P Global Default Risk Forecast); Private equity leverage trends.

2. Consumer Confidence

“Sentiment shifts signal demand risk before it hits the numbers.”

Shifts in sentiment are often the earliest signs of changing demand. Consumer caution affects discretionary spend and loyalty, while corporate confidence drives investment, hiring, and supplier commitments. These changes often appear before they’re visible in performance data — but carry real commercial impact.

What this means strategically:

Anticipate softer demand, shorter planning cycles, and rising price sensitivity. Shift focus to core segments, resilience in proposition, and retention.

What this means financially:

Revenue forecasts become less certain. Promotional intensity may increase. Demand fragility puts pressure on both pricing power and working capital.

Indicators to watch: GfK Consumer Confidence Index; S&P Global/CIPS UK PMI (Services & Manufacturing); Retail sales trends (value brand growth vs premium); Consumer Savings.

3. Labour Market Constraints

“People risk is now financial risk.”

Labour shortages, wage inflation, and shifting workforce expectations have become structural constraints on business performance. While input costs fluctuate quarter to quarter, wage pressures tend to stick — and hard to unwind. The availability and cost of talent now directly shape execution, capacity, and long-term cost models. Persistent scarcity, high pay settlements, and rising expectations around flexibility, benefits, and purpose are redefining cost structures for the decade ahead.

What this means strategically:

Leadership teams may need to delay transformation, restructure ops models, or accelerate digital/outsourcing strategies.

What this means financially:

Wage inflation raises fixed costs. Hiring delays hit delivery. National Insurance and employment changes increase statutory burden.

Indicators to watch: ONS vacancies vs. unemployment; Wage growth rates // Average weekly earnings growth; Labour market participation rates; NI contribution changes.

4. Input Cost Pressure

“Margin risk often starts upstream.”

Volatile input costs — from energy to freight — often hit margins before they show up in the numbers. These pressures ripple through pricing, procurement, and planning cycles, and even small swings can have strategic consequences. The ability to forecast, absorb, or pass on rising costs is now a critical differentiator.

What this means strategically:

Pressure on supply chains may drive re-sourcing, nearshoring, or investment in automation and hedging. Procurement becomes a value lever.

What this means financially:

Operating margins compress. Inflation-adjusted budgets must be reworked. Cost pass-through capabilities are tested sector by sector.

Indicators to watch: Producer Price Index (PPI); Brent Crude and Natural Gas Futures; Global shipping rates; Food & commodity input indices.

5. Fiscal & Policy Interventions

“Fiscal and regulatory changes increasingly shape business outcomes.”

Tax changes, subsidy shifts, and regulatory reform are now core drivers of business cost and investment feasibility. While some interventions are cyclical, others have lasting impact on margin structures, capital allocation, and competitive advantage. From National Insurance to planning rules, policy moves are reshaping the financial logic behind where and how businesses grow.

What this means strategically:

Leaders need to scenario-plan for policy shifts, reassess capital allocation, and consider the benefits of engaging with fiscal incentives.

What this means financially:

Changes to tax, subsidies, and regulation directly impact cost structures. NI, business rates, or delayed allowances can raise baseline costs, while targeted reliefs may create short-term margin opportunities.

Indicators to watch: National Insurance & Corporation Tax announcements; OBR & IFS fiscal outlooks; Budget statements (Autumn/Spring); Capital allowance & subsidy schemes.

6. Geopolitical Realignment

“New rules, new risks, new centres of influence.”

Global relationships are being redefined — not just by geopolitics, but by targeted economic policy. From sector-specific tariffs to rising scrutiny of supply chains and foreign investment, governments are intervening more directly in trade and capital flows. This shift is creating new complexity in how and where businesses operate.

What this means strategically:

Firms must reassess geographic exposure, rethink global footprints, and monitor political risk in key trading or sourcing regions.

What this means financially:

Import/export volatility affects lead times and costs. FX volatility impacts margins. Sanctions, tariffs, or local policy shifts may impair previously stable revenue streams.

Indicators to watch: UK-EU trade data and port delays; GBP/EUR and GBP/USD currency trends; FDI inflows/outflows; Global sanctions or trade policy updates.

Why this matters

In an environment defined by volatility, the ability to interpret external signals early is becoming a core source of competitive advantage. These six signals don’t offer certainty — but they do offer foresight.

For leadership teams under pressure to preserve margins, manage liquidity, and make disciplined investment choices, this kind of foresight is essential. The organisations that navigate uncertainty best won’t simply react faster — they’ll move earlier, because they saw it coming.

A case study

A European-regulated brokerage with a global presence had expanded rapidly through organic growth. As market conditions became more volatile — driven by regulatory shifts, diverging regional demand, and rising operational complexity — the CEO recognised the need for a more structured approach to guide the next phase of growth.

The mandate was clear: accelerate revenue while maintaining margin discipline and reducing dependency on a small set of mature markets. Q5 was engaged to help the executive team navigate uncertainty and improve the quality of investment decisions across their global portfolio.

The focus was to double revenue every two years (targeting a 45% revenue CAGR), review optimisation of a USD 30M marketing budget, and develop detailed go-to-market plans for the top 20 markets – covering more than 90% of the total revenue opportunity.

Working closely with global and local leaders, we analysed operating conditions, disaggregated performance across the portfolio, and identified where resources could be redeployed to maximise risk-adjusted returns without increasing overall spend. We supported market-specific budget planning, rationalised go-to-market investments, and helped prioritise a long list of strategic options.

The result was a clear shift from reactive expansion to disciplined market selection. The firm delivered consecutive record-breaking months, underpinned by smarter resource allocation, clearer accountability, and stronger alignment between market signals and strategic execution.

Looking ahead with confidence

Whether you’re looking to strengthen financial resilience, improve decision-making, or unlock value already within your organisation, we’re here to help. Get in touch to start a conversation — and take the next step toward clarity, control, and confidence in your organisation and its direction. Contact Henry Bell, Principal or Tom Leary, Partner.

We are all about organisational health, which separates good organisations from the great. Whether our clients are at the top of their game (and want to remain there) or are in ‘turnaround’ mode, we all need to work on our organisational health.

Whatever the situation, be it a strategic conundrum, a market opportunity, or an operational gripe, we combine the art and science of organisational health to help our clients improve and excel.

Please visit the firm link to site