Inheritances often seem like a gift from heaven—unearned, often tax-free, and sometimes viewed with a touch of moral suspicion. What’s frequently overlooked, however, is that the wealth being inherited has already been taxed multiple times. Anyone who earns, invests, and eventually transfers wealth pays a long list of taxes along the way. Altogether, the total tax burden is higher than most people think—especially for the wealthy.

To illustrate how these taxes add up over time, let’s consider a simple thought experiment: three residents of Zurich each take part in a project and earn an extra CHF 10,000, which they invest and plan to bequeath after 25 years. One is an employee with an average income, one is an entrepreneur, and the third is a multimillionaire. The goal is the same—but the tax burden is very different.

What Really Remains After Taxes

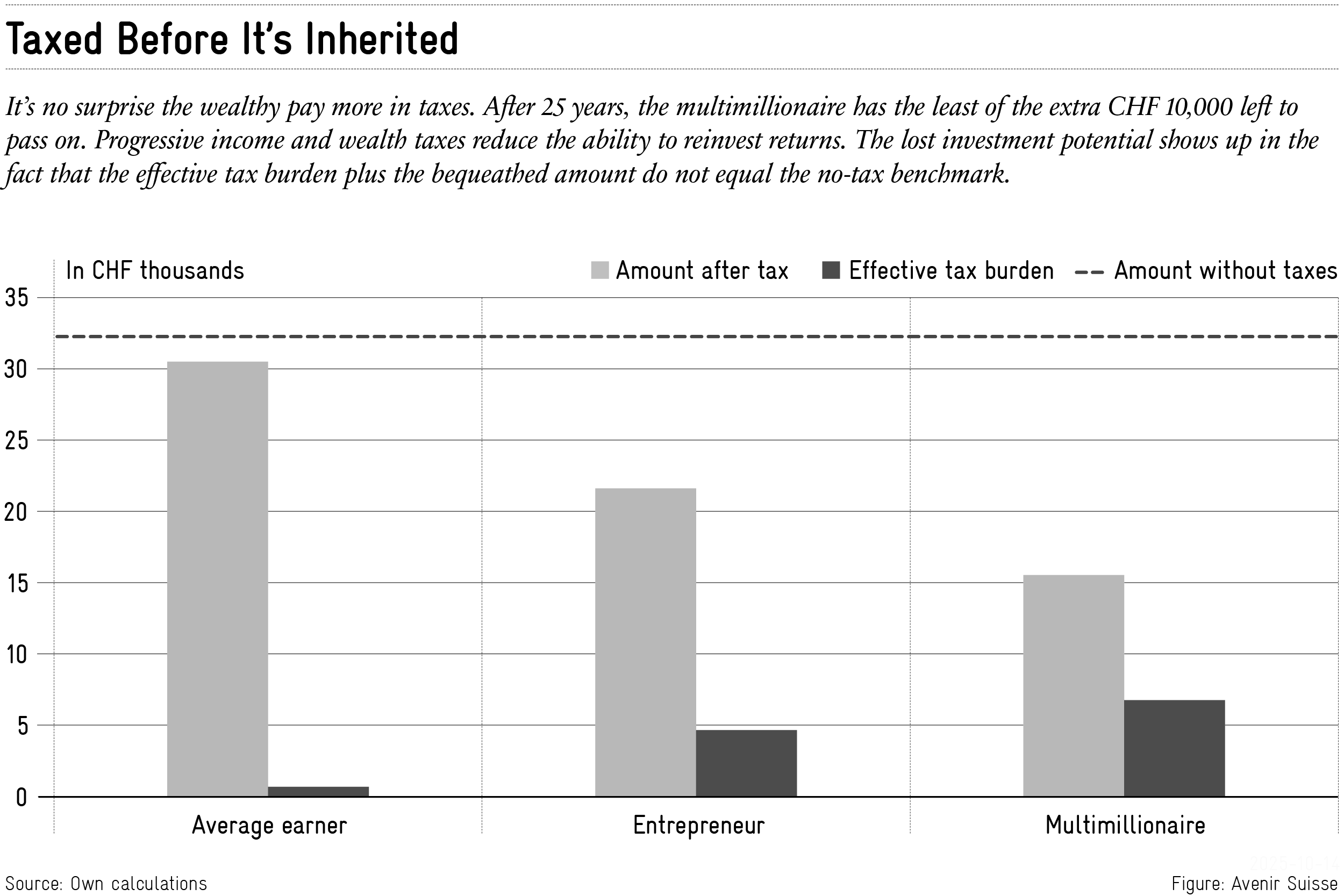

In a hypothetical world without taxes, all three would end up with around CHF 32,250 after 25 years (see box for assumptions). But that’s just theory. In reality, the money is subject to various taxes over that period.

The first tax bite comes immediately when the CHF 10,000 is earned. Income tax in Switzerland is progressive—the higher your total income, the higher your tax rate. The multimillionaire, who already earns a substantial income, gives up nearly a third of the additional income in taxes. The average employee keeps a larger percentage. And for simplicity’s sake, social security contributions aren’t even included here—if they were, the differences would be even greater.

Whatever remains after income tax is then subject to annual wealth tax, which increases with the size of the fortune. Over 25 years, this creates a significant, creeping burden—especially for high-net-worth individuals.

On top of that, anyone who invests their wealth ideally earns attractive returns—but those returns are taxable as well. While capital gains from private assets are tax-exempt in Switzerland, distributions such as dividends and interest are taxable income.

After a quarter century, the results are telling (see chart): from the original CHF 10,000 investment, the average earner ends up with CHF 30,575, the entrepreneur with CHF 21,725, and the multimillionaire with CHF 15,600. The comparison highlights three key insights:

1. Wealth is already heavily taxed today. Income and wealth taxes together add up to substantial amounts. Over 25 years, the multimillionaire pays nearly CHF 6,900 — about two-thirds of the amount originally invested. In other words, more than half of the theoretically accumulated wealth is lost to taxation.

2. Taxes have opportunity costs. Because part of the wealth is continuously taxed, less capital is available for reinvestment. These forgone returns—the opportunity cost of taxation—compound significantly over 25 years.

3. Taxes redistribute wealth substantially. On the same initial CHF 10,000, the multimillionaire pays roughly ten times as much as the average earner in the first year alone, due to income and wealth taxes.

The takeaway: In this example, the wealthy end up with less net wealth—and the larger the fortune, the greater the tax burden. This is intentional under Switzerland’s progressive tax system, which aims for higher earners to contribute more to the common good. Still, the question remains: how far should redistribution go — especially when new taxes are proposed?

When Inheritances Are Taxed on Top

New inheritance taxes would increase the overall burden even further. Several models are conceivable. A recently submitted popular initiative, for example, proposes a 50% inheritance tax on estates exceeding CHF 50 million. If that measure were implemented, the multimillionaire’s heirs in our example would keep only CHF 7,800 of the potential CHF 32,250 — meaning 75% of the theoretical wealth would be lost to taxation.

Following the multimillionaire’s heirs for another generation — in true Buddenbrooks fashion—after 50 years, only CHF 8,950 of a potential CHF 104,000 would remain. A full 91% of the wealth would have been lost to taxes by the third generation. What’s left wouldn’t even equal the grandmother’s original additional earnings.

Of course, this is only one possible scenario. Location plays a crucial role: in the canton of Zug, the employee would pay no income or wealth tax at all, while the multimillionaire in Lausanne would fare worse than in Zurich — losing up to 60% of the theoretical wealth to taxation.

Another important factor is how large fortunes are structured—through real estate, business ownership, foundations, or foreign investments. Depending on how assets are distributed, both returns and tax burdens vary.

Yet most scenarios share one thing in common: annual income and wealth taxes have major cumulative effects over time. Wealth tax in particular affects even those without ongoing income, as it taxes not cash flow but substance — the mere holding of wealth. In this sense, it acts as a kind of “minimum tax” for the rich.

Whether one supports an inheritance tax or not, it’s important to first acknowledge the existing tax burden and redistributive effects of today’s system. Inheritances, in fact, mark the end of a long tax story—not its beginning.

Box: The Three Zurich Residents

Base assumptions for the example:

|

Average Earner

|

Entrepreneur

|

Multimillionaire

|

|

|---|---|---|---|

| Income (CHF) |

85,000

|

250,000

|

1,000,000

|

| Wealth (CHF) |

150,000

|

5,000,000

|

50,000,000

|

| Capital Gains (p.a.) |

2.5%

|

2.5%

|

2.5%

|

| Distributions (p.a.) |

2.5%

|

2.5%

|

2.5%

|

According to the Swiss Federal Statistical Office, the median monthly salary in 2022 was CHF 6,788. The median wealth of an adult in Switzerland was USD 171,035 in 2023 (UBS Global Wealth Report). Based on these figures, we define the “average earner.” The entrepreneur and multimillionaire are hypothetical. The latter, with assets exceeding CHF 50 million, would fall under the scope of the “Initiative for a Future.”

|

Average Earner

|

Entrepreneur

|

Multimillionaire

|

|

|---|---|---|---|

| Additional income (CHF) |

10,000

|

10,000

|

10,000

|

| Income tax |

3.11%

|

16.64%

|

31.7%

|

| Wealth tax |

0.2‰

|

4.7‰

|

6.3‰

|

| After 25 years without taxes (CHF) |

32,251

|

32,251

|

32,251

|

| After 25 years with taxes, no inheritance tax (CHF) |

30,577

|

21,715

|

15,607

|

| Total tax burden |

5.19%

|

32.67%

|

51.61%

|

The tax rates reflect the overall tax burden in Zurich in 2024 for a single person with two children under each scenario (based on the 2025 ESTV Tax Burden Statistics). Average overall rates—not marginal rates—were used to keep estimates conservative.

The assumed returns align with the historical average real performance of the Swiss stock market (5.6% per year since 1926, according to Pictet). After fees, a 5% annual return remains. Historically, dividends accounted for roughly 50% of total returns, with the remainder from price appreciation (ZKB, 2025)—a split that was applied here.

Today, only about one in ten people in Switzerland inherits before age 60 (AXA, 2023). Given an average life expectancy of around 85 years, that leaves roughly 25 years between receiving and passing on an inheritance—hence the chosen investment horizon.

Under these assumptions, the respective tax rates determine the total burden.

“Avenir Suisse is an independent think tank that works for the future of Switzerland by developing evidence-based, liberal, free-market ideas.”

Please visit the firm link to site