The economies at the heart of the Eurozone, particularly Germany, are showing sluggish growth at best, while the Iberian economies are being buoyed by strong private consumption and investment, the latter supported by funds from the European Recovery and Resilience Plan. In the United Kingdom, growth was the strongest among the G7 countries in the first half of the year, but with modest growth in private consumption and a decline in investment. The pace of growth has slowed significantly since the pandemic, and the UK economy has yet to return to its trend GDP level or growth rate. In contrast, the Eurozone has now recovered the growth lost during the Covid shock and its growth rate has returned to its (lower) pre-pandemic potential.

This pace is ensured by the dynamism of labour supply, which is still meeting demand despite the slowdown in the cycle. The resilience of employment is essential to maintaining this narrative of cautious optimism. However, the latter is supported in the Eurozone by a more favourable economic policy stance and by the recovery in the credit cycle, which is fuelling the revival of investment. In the United Kingdom, however, persistently high inflation is forcing the central bank to halt its easing process, even as fiscal policy becomes more restrictive and the unemployment rate is expected to rise.

The risks to our scenario of accelerating growth in the Eurozone and a moderate slowdown in the United Kingdom are skewed to the downside. Although the EU and the UK have benefited from the most favourable terms among the new tariffs imposed by the United States on its trading partners, these remain punitive and uncertainty about future relations with the United States remains, with the confrontation with the Trump administration being hybrid and multifaceted, and potentially spreading to other fronts (FDI, digital services, financial stability, defence). Furthermore, the risk of Chinese trade flows being diverted from the American continent to Europe is emerging as the main deflationary threat to the continent.

The Eurozone continues its recovery…

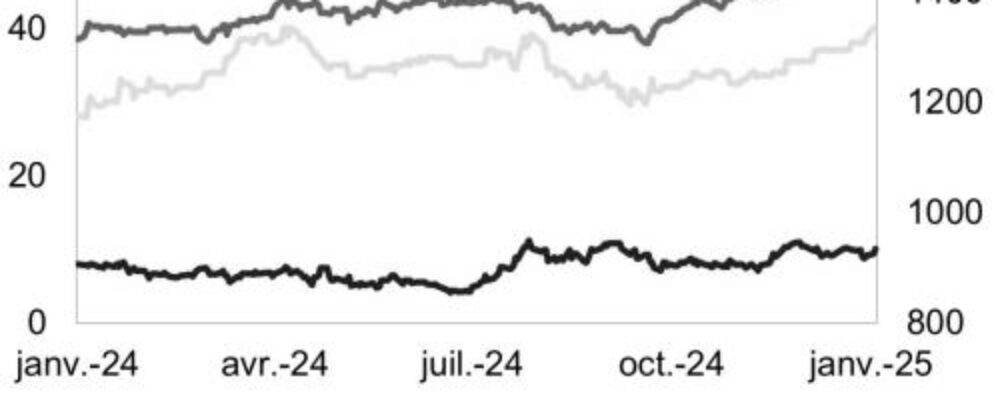

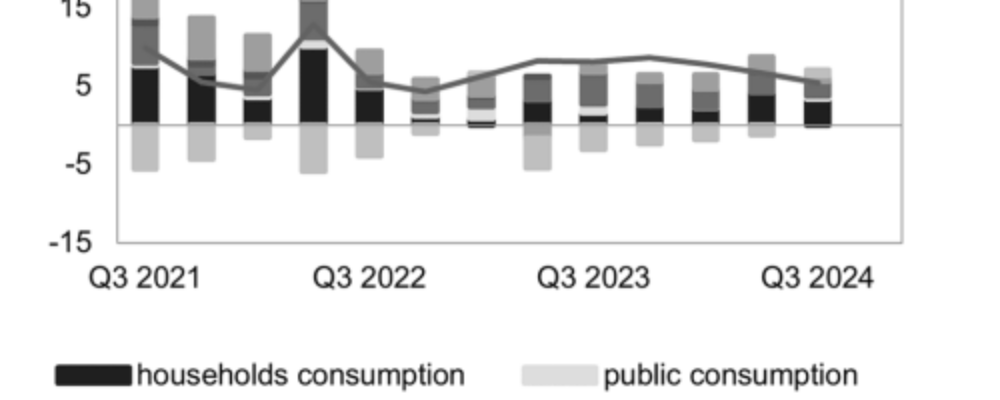

Since its recovery in the summer of 2024, growth in the Eurozone has settled at a pace close to the trend for the period 2013-2019, gradually shaking off the factors that had been weighing it down since 2022 (inflation, monetary tightening, post-pandemic fiscal restraint, credit cycle). It is showing some resilience to new headwinds (euro appreciation, higher tariffs and uncertainty). While the easing headwinds have mainly weighed on domestic demand, the new obstacles are having a greater impact on foreign demand. Domestic demand is showing resilience, which is supporting GDP growth. Despite past headwinds, the labour market has shown strong resilience, with an unemployment rate lower than would be expected for such a rate of GDP growth. However, growth is now less job-rich, hours worked are increasing only slightly and the unemployment rate has stabilised over the past year. Gains in purchasing power persist, even though real wages per worker have only recovered to their pre-2022 inflation shock levels.

With margins under pressure from external competitiveness damaged by euro appreciation and higher customs duties, the question arises as to whether this resilience in both employment and wages will continue. The acceleration in growth in our scenario is based on the assumption that employment will remain resilient and the unemployment rate will fall slightly. Corporate profitability, although currently eroding, remains in line with its historical average, and consumers can rely on historically high savings.

… with mixed performances…

French growth surprised on the upside in the second quarter of 2025, and activity is expected to continue to grow moderately in the second half of the year. This would result in modest growth in 2025, at a rate of 0.7%. Despite possible wait-and-see effects on private sector behaviour due to uncertainty, activity is expected to accelerate at an annual rate of 1.2% in 2026. The acceleration in activity would be driven by the impact of German government measures and increased defence spending in the European Union, as well as by the acceleration in private consumption and the recovery in domestic business investment.

The German economy remains mired in weak manufacturing activity and a deterioration in its competitive position. Growth in 2025, forecast at 0.1%, is still being held back by sluggish private consumption and a decline in investment in its productive components and in housing. The outlook for 2026 is improving significantly with the announcement of additional spending, forecast to increase by 1% of GDP in 2026, which should support an acceleration in growth to 1.2%.

The Italian economy is struggling to regain momentum in 2025, with growth forecast at 0.5%. Despite continuing difficulties in the industrial sector, investment remains surprisingly resilient in 2025, supported by the Transition 5.0 plan and the easing of financing conditions. Consumption remains the weak link, penalised by a less dynamic labour market and purchasing power that is still under pressure. For 2026, we anticipate a slight acceleration in growth to 0.6%.

Spanish growth is expected to remain well above the Eurozone average in 2025 at 2.8%. Rising labour costs, inflation contained by lower margins and a gradual moderation in public investment define the new economic environment in Spain. Domestic demand remains the main driver of activity, supported by resilient private consumption and dynamic residential and productive investment, while public consumption continues to grow at a moderate pace. External demand, weakened by the slowdown in global trade and the decline in goods exports, will make a limited contribution to GDP growth, despite the continued strength of services. The Spanish economy in 2026 would therefore enter a phase of gradual normalisation of the pace of expansion to 2%, more in line with its potential.

“Crédit Agricole Group, sometimes called La banque verte due to its historical ties to farming, is a French international banking group and the world’s largest cooperative financial institution. It is France’s second-largest bank, after BNP Paribas, as well as the third largest in Europe and tenth largest in the world.”

Please visit the firm link to site