10 February 2026

Import tariffs imposed by other countries tend to lower euro area inflation and weaken growth. However, the sectors most exposed are also the most responsive to interest rate changes. This means that monetary policy can help offset disinflationary pressures and support activity.[1]

Tariffs are a tax on trade. The immediate impact falls on the country imposing them, as import prices rise and trade volumes fall. But trading partners can also be affected. On the one hand, higher import costs reduce demand for their products in the tariff-imposing country. Moreover, other countries hit by tariffs may divert some of their exports to other markets, increasing supply and lowering prices in those economies. Through these channels, import tariffs imposed by one country can reduce economic output and lower inflation abroad. On the other hand, when large and globally integrated economies impose tariffs, they raise costs along global value chains, by making inputs more expensive and increasing production prices. Such supply-side effects can lead to higher inflation in trading partners’ economies, even if these countries do not raise tariffs themselves.

Changes in trade dynamics also affect exchange rates. A common assumption is that since higher tariffs lead to lower imports, the demand for foreign currency falls in the country imposing the tariff, which should lead to an appreciation of its own currency relative to those of its trading partners. However, higher import prices and lower activity in the tariff-imposing country could also mean that the domestic central bank either raises or lowers interest rates, depending on how it weighs price stability versus economic growth in its decision-making. In turn, a change in the relative interest rate will affect the exchange rate, reinforcing spillovers to other economies.[2]

All of this means that the consequences of one country’s import tariffs for other countries’ economies are influenced by a wide range of partly opposing effects. In this blog, we analyse which of these effects dominates, on balance. We estimate how declining trade volumes with the US following increases in US tariffs affect the euro area. When trade falls by more than expected after a rise in tariffs – a situation we call a “tariff-related trade surprise” (TTS) – euro area inflation declines and economic activity weakens over the medium term. Our results therefore suggest that the effects of the drop in demand due to US tariffs on the euro area outweigh any inflation-boosting supply effects.[3]

Monetary policy can soften these effects. We find that the impact of US tariffs differs notably between sectors. Those sectors hit hardest by TTSs are also those that respond most strongly to interest rate changes. Consequently, monetary policy can help counter the adverse effects of higher trade barriers.

Identifying tariff-related trade surprises

To study the impact of tariffs, we identify TTSs by linking unusual trade patterns with historical data on US tariff changes in a novel two-step approach.

First, we estimate how much trade between countries would normally be expected. To do this, we use a standard “gravity” model of trade. This model covers monthly exports from 20 euro area countries to 192 trading partners over the pre-pandemic period (2002-19). We control for common factors that affect individual exporting and importing countries as well as those that affect each country-pair together, such as structural economic and financial conditions, local and global business cycles, or membership of bilateral or multinational agreements and institutions. After accounting for the main drivers of trade, we extract the part of euro area exports to the United States that the gravity model cannot explain. We call these unexplained variations in exports “trade surprises”, since they reflect unusually strong or weak trade compared with historical patterns.

Second, we isolate those trade surprises that are plausibly related to tariffs. To this end, we compare the sign of the trade surprise with preceding changes in US tariffs on euro area goods. When effective US tariffs on euro area goods rose over the previous year, and euro area exports to the United States were unexpectedly weak, we interpret this as a trade-tightening TTS. When tariffs fell and euro area exports were unexpectedly strong, we treat it as a trade-easing TTS.[4] We then estimate how the TTSs identified affect euro area prices and activity using local projections.[5]

Effects on prices and activity

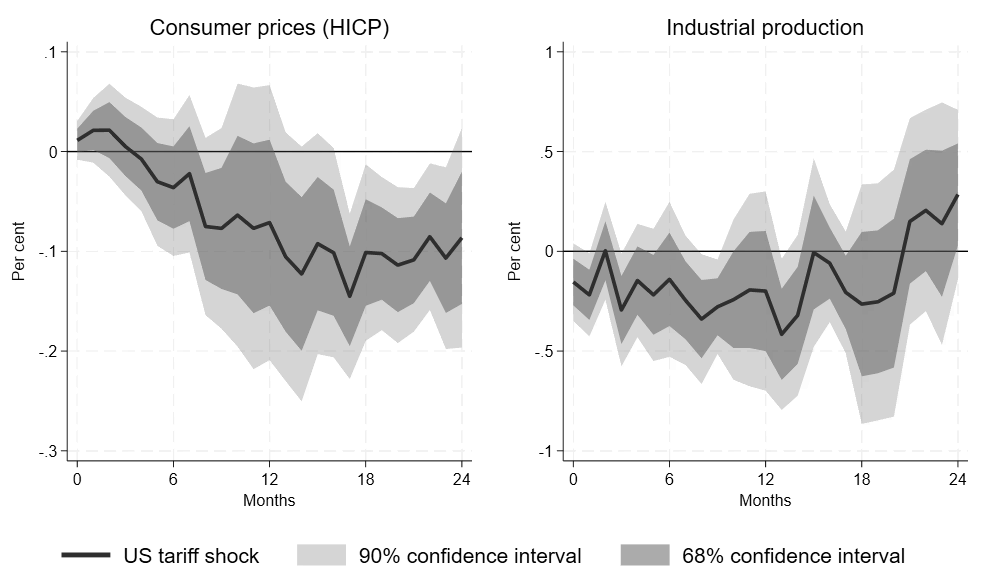

Immediately after a TTS, euro area prices edge up slightly, consistent with higher production costs spreading through supply chains (Chart 1). Over the medium term, however, prices begin to fall. At its lowest point, about one and a half years after a TTS that cuts euro area exports to the United States by 1%, the consumer price level[6] is around 0.1% lower. Euro area activity follows a similar pattern, with industrial production declining over this period before stabilising. Taken together, the pattern of lower prices and weaker activity resembles an adverse demand shock.[7]

Chart 1

Impact of a euro area-specific US tariff-related trade surprise on the euro area economy

(percentage changes)

Notes: Impulse responses are derived by local projections estimated in long-differences (see for example Jorda and Taylor, 2024). Tariff-related trade surprises (TTSs) are identified using a two-step process. In step one, residuals from a three-way gravity model with importer-time, exporter-time and country-pair fixed effects are estimated to capture regular drivers of bilateral trade. Step two involves applying simple sign restrictions that directly associate negative (positive) residuals with tariff increases (decreases) observed over the preceding year, isolating the tariff-related component from other unexplained influences. We then feed the identified TTSs into local projections. TTSs are scaled to a 1% trough decline in bilateral exports of euro area countries to the United States in the first year after the shock. The local projections include the first six lags of several euro area macroeconomic and financial market control variables, including industrial production, bilateral euro area exports to/imports from the United States, the HICP, the unemployment rate, the EUR/USD exchange rate, the euro area Composite Indicator of Systemic Stress, the three-month overnight index swap rate, GDP-weighted ten-year sovereign bond yields, and the International Monetary Fund commodities price index. We also include forward controls entering the model at the same t+h-step horizon as the dependent variable to account for the COVID-19 period and the start of the Russian invasion of Ukraine.

Sectoral differences

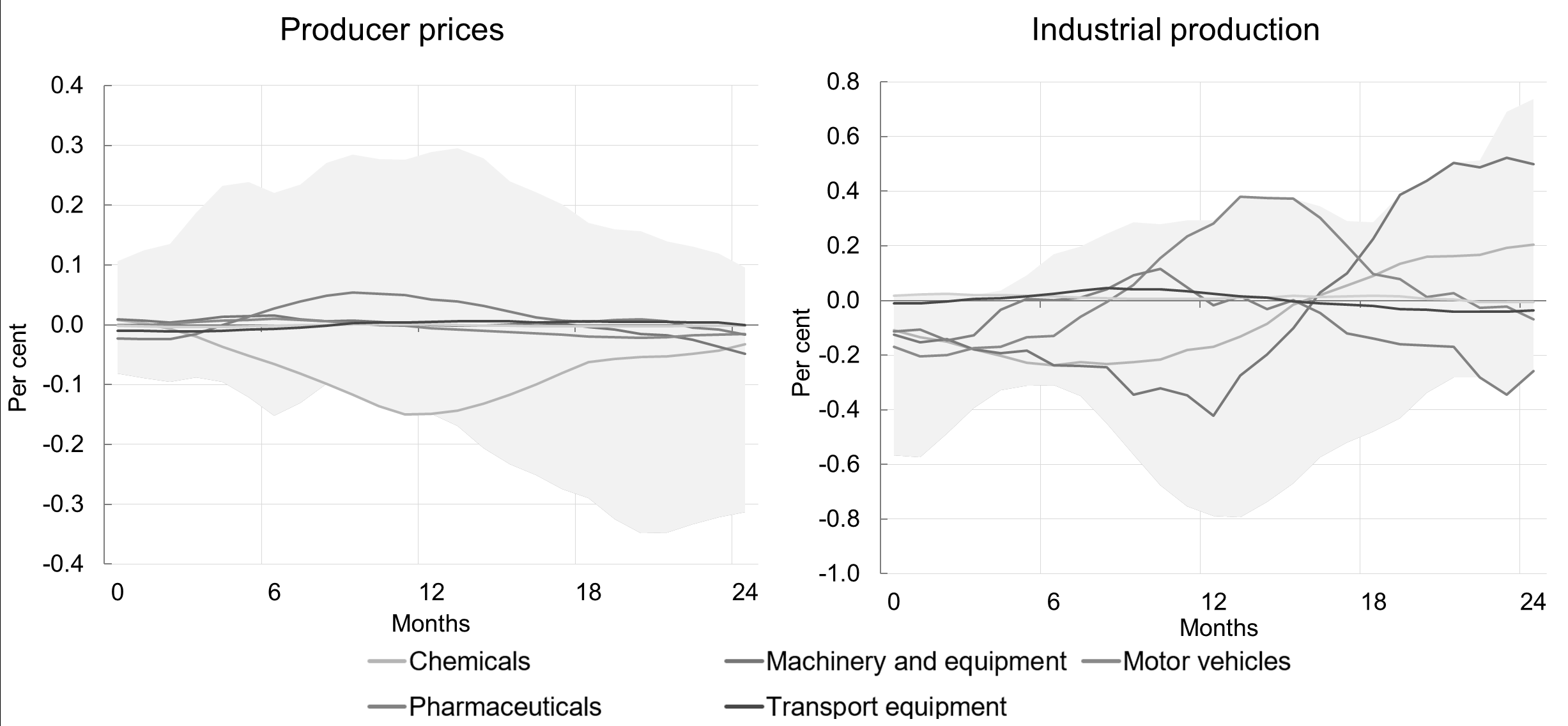

We also find that the force with which TTSs hit different industries varies (Chart 2).[8] In “downstream” sectors, which predominantly produce final goods such as machinery, autos and pharmaceuticals, the peak impact of a tariff-tightening shock usually occurs one to two years after a TTS, as the shock takes time to transmit through production chains.[9] When we scale the surprise to a 1% fall in bilateral exports, output in these sectors declines by about 0.3% on average and producer prices fall by about 0.1% one year after the TTS. “Upstream” sectors producing predominantly intermediate inputs, like chemicals, can react on a different timeline. As these sectors operate primarily at the beginning of the value chain, they are more likely to be immediately affected by tariff changes.

Chart 2

Impact of a sector-specific US tariff-related trade surprise on euro area sectors

(percentage change)

Notes: Impulse responses are derived by local projections estimated in long-differences (see for example Jorda and Taylor, 2024). Tariff-related trade surprises (TTSs) are identified following the same two-step approach as described in the notes to Chart 1 and are scaled to a 1% trough decline in bilateral sector-specific exports of euro area countries to the United States in the first year after the shock. The local projections include the first six lags of several euro area macroeconomic and financial market control variables, including industrial production, bilateral euro area exports to/imports from the United States and China, the HICP, the unemployment rate, the EUR/USD exchange rate, the euro area Composite Indicator of Systemic Stress, the three-month overnight index swap rate, GDP-weighted ten-year sovereign bond yields, the IMF commodities price index, and the aggregate TTSs as identified for the aggregate results presented in Chart 1. The grey area covers the min-max range of impulse responses estimated for a reference set of other manufacturing sectors.

Can monetary policy soften the impact?

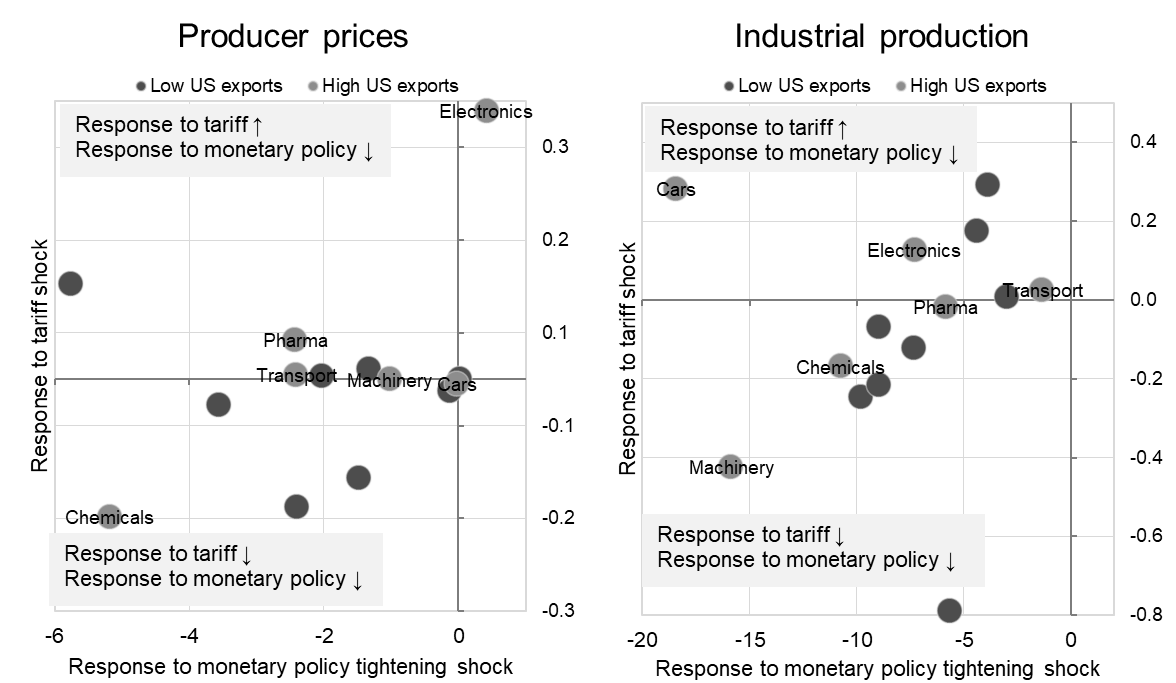

The sectors hit hardest by TTSs also respond most strongly to interest rate changes. Our results show that sectors with larger declines in prices and output in the 12 months after a TTS tend to be more sensitive to an easing of monetary policy over the same horizon (Chart 3).[10]

Chart 3

Impact of sector-specific US tariff and monetary policy shocks on euro area sectors after one year

(percentage change)

Sources and notes: The x-axis shows the impulse response to a monetary policy tightening shock (based on Altavilla et al. 2019) scaled to a 100-basis point peak response in the first year after the shock, evaluated 12 months after the shock. The y-axis shows the impulse response to an adverse sector-specific US TTS scaled to a 1% trough decline in bilateral sector-specific exports of euro area countries to the United States in the first year after the shock. The colours of the dots indicate below-average (blue) or above-average (orange) sectoral exports to the United States in shares of total export volumes reported by the manufacturing sectors that were evaluated. Impulse responses are obtained from the same local projections model as in Chart 2.

This means that, for instance, output in the machinery sector drops sharply following a TTS. But production in this sector also expands particularly strongly in response to an easing of domestic monetary policy. We find that this pattern holds for about 60% of the sectors we study – representing roughly 50% of total average euro area industrial output and of total goods exports to the United States. TTSs push prices and activity down one year after the incidence, but easier monetary policy supports them. This suggests that monetary policy remains a powerful tool to counter TTS-induced disinflation and to cushion the drag from higher trade barriers.[11]

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Check out The ECB Blog and subscribe for future posts.

For topics relating to banking supervision, why not have a look at The Supervision Blog?

“The European Central Bank is the prime component of the Eurosystem and the European System of Central Banks as well as one of seven institutions of the European Union. It is one of the world’s most important central banks.”

Please visit the firm link to site