16 February 2025

Artificial intelligence has the potential to make economic research more effective. But how exactly? This ECB Blog post gives a concrete example. We look at the use of AI to streamline the processes and analytical capabilities of our Corporate Telephone Survey.

At the European Central Bank, we use artificial intelligence in our work where appropriate. For example, we use AI to collect, clean and analyse vast amounts of data which feed into our work on statistics, risk management, banking supervision and monetary policy analysis.[1] This ECB Blog posts takes a closer look at one such application of artificial intelligence: the Corporate Telephone Survey that we use to gather intelligence from big business about the state of the economy.

What is the Corporate Telephone Survey?

The Corporate Telephone Survey (CTS) gathers qualitative information from large corporations about current economic developments. This includes supply and demand conditions, emerging price pressures and labour market dynamics.[2] It offers insights into how businesses view economic developments, which can feed into monetary policy decisions.

Each quarter, ECB economists conduct around 70 video interviews with senior representatives of large companies active across different sectors of the euro area economy. Each interview lasts around 30 minutes. As well as generating valuable input for the ECB’s economic analysis and monetary policy decision-making, the main findings are also shared with the public in the ECB’s Economic Bulletin.

Traditionally, the CTS process has been quite labour intensive. One economist usually conducts the interview while another takes handwritten notes.

We use notes to draft a one-page meeting summary. Following each discussion, the economists “score” the respondent’s assessment of activity, prices, costs, wages and employment – on an ordinal scale ranging from -2 for “extreme decrease” to +2 for “extreme increase” – in increments of 0.5. A summary team then distils the overall narrative by reviewing all individual meeting summaries and drafting an overall summary report.

The CTS often serves as an early indicator of shifts in the economy in real time. And it particularly helps to improve understanding of how businesses are reacting to economic shocks. For example, during the pandemic our CTS contacts were quick to signal how global manufacturers were adapting and consequently enabling a recovery in activity.

How are we deploying AI?

So, what does using AI for the CTS actually look like?

First, we are modernising the workflow by integrating large language models (LLMs) to automate several key steps. With permission from survey participants, we use speech-to-text AI models embedded in video conferencing tools to create meeting transcripts. After being redacted to preserve confidentiality, these transcripts are summarised by LLMs.

Initial experiments with off-the-shelf chatbots delivered only modest productivity gains, so we have developed our own bespoke LLM tool.

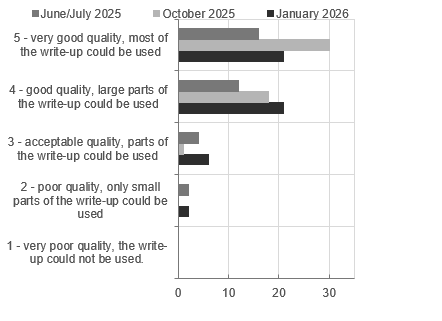

Early results show that our AI-generated summaries are of similar quality to those written by humans – so much so that economists in the CTS team are confident the LLM output can typically be used with limited subsequent human refinement (Chart 1).

Even while still in the process of development, these LLM summaries are estimated to have saved around 25 person-hours in each of the first two survey rounds. And at least 31 person-hours in the latest iteration in January 2026. This modernisation of our process also reduces the risk that relevant information is lost or misinterpreted.

We are now testing whether LLMs can effectively summarise the key messages from all individual interview summaries. In the future this should support the team in drafting our overall CTS summary published in the Economic Bulletin.

Chart 1

Feedback on the quality of AI-generated summaries

(number of summaries)

Source: ECB CTS staff.

To ensure high quality output that requires minimal human redrafting, we have systematically evaluated summaries generated with different prompt instructions and model parameters.

We are using cosine similarity to compare AI output with summaries drafted by humans. It has enabled us to refine prompts and mitigate problems such as repetitive style, erroneous tone and hallucinations.

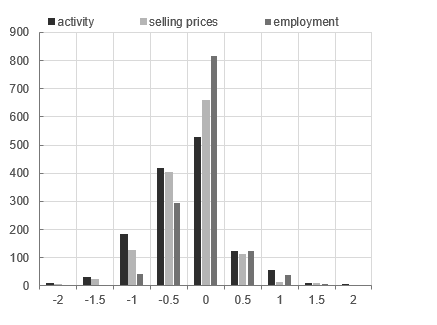

We are also currently working on LLMs assisting economists in scoring interviews. With targeted prompts based on our guidelines, AI scores each variable and explains its decisions based on the transcripts. Initial evaluations show strong correlation between AI-generated and human scores, with deviations centred around zero and a mean absolute deviation of less than 0.5 on the ordinal scale (Chart 2).

Chart 2

Distribution of differences in numerical scoring between LLM and human

(y-axis: number of experiments; x-axis: score)

Source: ECB CTS staff.

Notes: The ordinal scale ranges from -2 (extreme decrease) to +2 (extreme increase) in steps of 0.5, thus the possible range for differences in scoring between LLM and human scores would be from -4 to +4. A value of 0 indicates the LLM output is in line with the human scoring. The sample size is 136 interviews with transcripts, from October 2024 to October 2025. Owing to the random behaviour of LLMs each transcript was scored 5 times. We score each variable separately for the assessment of the previous three months and the expectations for the next three months, but for simplicity we combined their (similar) distributions in these charts.

Can AI enhance efficiency and improve economic analysis?

AI’s role in the CTS extends beyond operational improvements.

For instance, AI-powered agents embedded in standard office applications can automate scheduling by processing participants’ availability and proposing optimal meeting times. AI can also summarise news datasets and company websites, providing economists with useful background information on corporations and their markets before interviews.

Furthermore, the rich textual data gathered through the CTS offer new analytical possibilities.

We are working on a chatbot application capable of answering ad hoc queries like “How have companies reacted to trade tensions during the first and second Trump administrations?” This could significantly enhance the speed and accuracy of extracting insights under tight deadlines.

For example, ahead of the latest Governing Council meeting, we leveraged AI to quickly analyse three years of interview summaries with food producers and retailers.

This helped uncover drivers of food price inflation, as seen by our corporate contacts. In particular, respondents cited more frequent price swings for fruit and vegetables because of extreme weather. They also observed higher meat prices resulting from a structural decline in supply as a response to climate regulation. This was in line with broader increases in food prices caused by the impact of minimum wage increases in the food and retail sector.

We intend to use the extensive CTS text dataset, with human-written interview summaries available since mid-2007, to create quantitative indicators, such as measures of economic sentiment or uncertainty.

These quantitative indicators could enhance our understanding of economic trends, in a similar manner to recent research on corporate earnings calls.[3] Unlike earnings calls, the CTS dataset focuses on euro area developments and also includes insights from large companies not listed on stock exchanges.

The humans in the machine: what this mean for the people involved?

AI is clearly reshaping our approach to the CTS – so where does this leave the people who have already been doing this work for years?

The short answer is: human expertise remains indispensable.

AI is supporting central bankers rather than replacing them. It provides drafts and quantitative insights, which ECB staff review and refine to ensure accuracy and nuance. This human-machine synergy allows us to uphold the ECB’s high standards while rapidly delivering insights to inform policy decisions.

It is also important to emphasise that data protection and confidentiality remain at the heart of our approach – participants can always opt out of AI interview transcription and, for those that do so, we continue to conduct interviews using traditional methods.

A promising path forward

Our experience illustrates that AI productivity gains are made gradually and are by no means automatic: upfront investment is required.

Benefiting from AI depends on careful testing, continuous feedback from staff and careful workflow integration. Strong human oversight and safeguards are a must.

Building on the lessons learned from the CTS and other AI tools, we will continue refining our AI systems – and we see significant potential for further strengthening the ECB’s ability to monitor and respond to economic developments.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Check out The ECB Blog and subscribe for future posts.

For topics relating to banking supervision, why not have a look at The Supervision Blog?

“The European Central Bank is the prime component of the Eurosystem and the European System of Central Banks as well as one of seven institutions of the European Union. It is one of the world’s most important central banks.”

Please visit the firm link to site